Markets content with a 'not too cold' economy

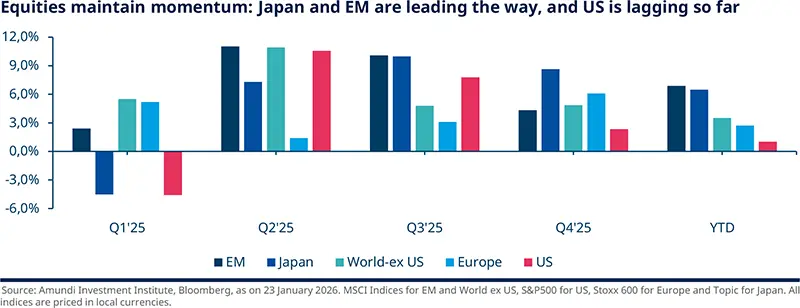

The year began eventfully, with the US using its military strength and economic leverage to achieve President Trump’s foreign policy goals. The Fed receiving subpoenas and military action in Venezuela did not move oil prices and risk assets. But his threats to the sovereignty of a NATO ally sparked temporary volatility, with markets eventually recovering from that scare and US lagging the other regions. Fiscal profligacy and inflation concerns in Japan pushed bond yields up.

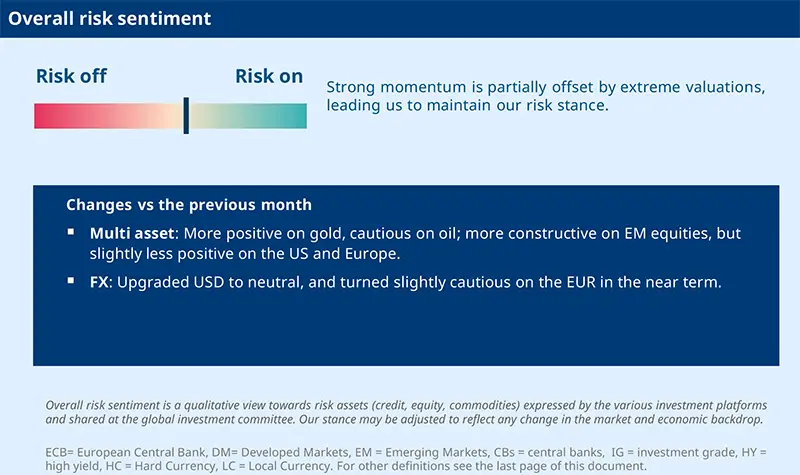

We think economic growth that is neither too hot nor too cold to trigger a recession, along with a high degree of complacency among markets participants, could explain the continued appreciation of risk assets. In this scenario, modest GDP expansion and disinflation is allowing central banks to move cautiously, preserving market liquidity.

The path ahead is fraught with risks to the independence of the Fed, and Trump’s domestic policies as well as his stated intention to shake-up traditional alliances. Any challenge to the Fed could result in de-anchoring of inflation expectations (not our base case but risks are rising). All this favours our views of diversification out of US assets, and for Europe to pursue its strategic autonomy. For now, we observe strong US economic momentum, and have raised our Eurozone (EZ) growth projections:

"We expect US GDP to expand this year at below-potential level of 2%, after accounting for fiscal support".

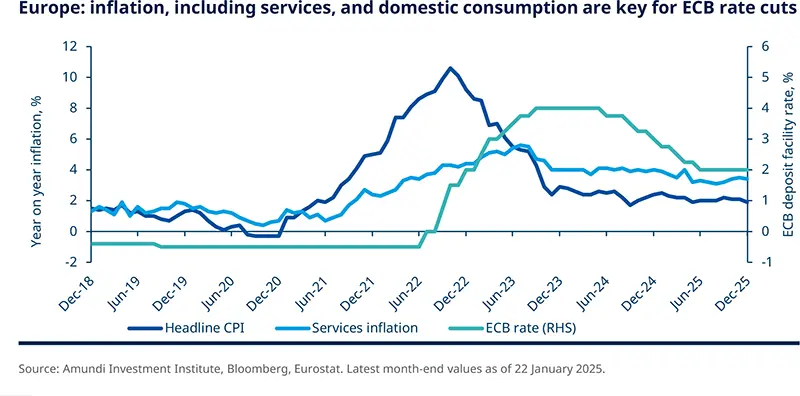

"We expect the ECB to reduce policy rates twice this year, provided consumption remains modest, inflation slows, and wage growth decelerates. We are monitoring how the ECB revises its assessment of inflation, which will give us greater clarity on the bank’s actions".

Monica DEFEND

Head of Amundi Investment Institute & Chief Strategist

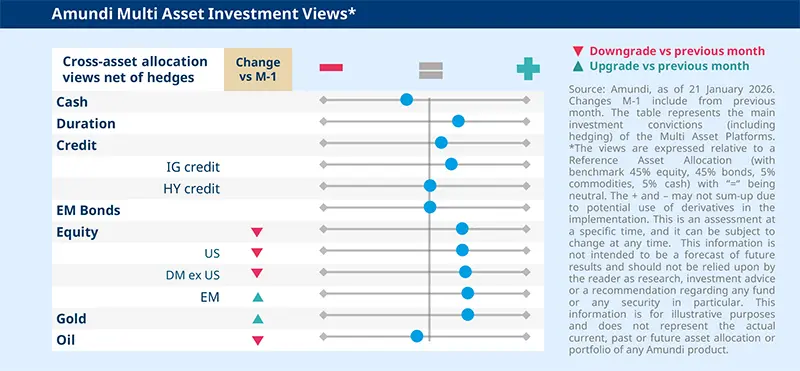

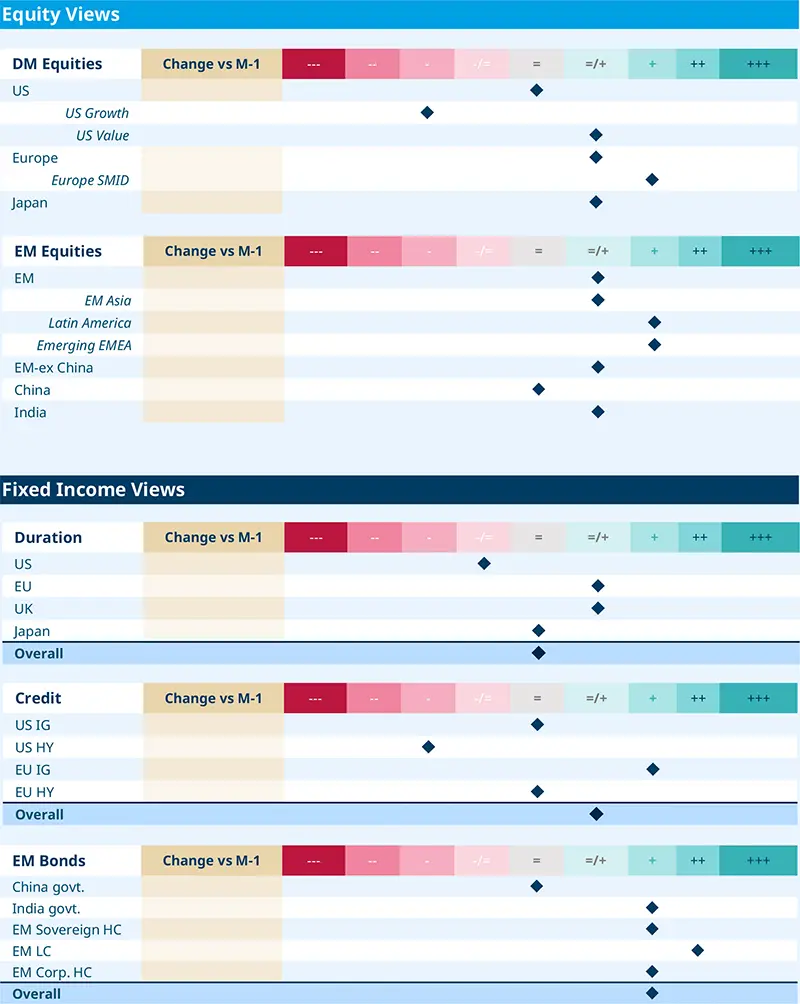

In an environment of disinflation in Europe, fiscal support and ‘political noise’ in the US, and China stabilising to a lower growth rate, we stay risk-on with our asset class views as follows:

"Trump’s actions on Greenland/NATO, the US mid-term elections, and tariffs and the European response will drive the near-term market momentum".

FIXED INCOME

Inflation: the key to the ECB’s policy puzzle

Amaury D’ORSAY

Head of Fixed Income

Market pricing with respect to ECB rate cuts is asymmetrical, implying they do not expect a rate cut. However, we think the disinflation trajectory will be maintained in the eurozone (EZ), with price pressures undershooting the ECB’s 2% target. As a result, for us, the probability of interest rate reductions is much higher than the probability of a hike. We are also monitoring how the more dovish voices in the ECB could gain prominence and that could further tilt the case towards rate cuts.

In the US, the Fed’s independence, the leadership transition, and labour markets (showing signs of weakening) would keep the market’s attention. We maintain our global focus on yield curves, and look for carry through corporate credit and emerging market bonds in a selective manner.

Duration and yield curves

Corporate credit

EM bonds and FX

EQUITIES

Prefer structural stories over euphoria

Barry GLAVIN

Head of Equity Platform

US and European equities reached record levels in January despite mixed economic and geopolitical newsflow. Now, valuation dispersion across regions, together with earnings strength, will determine which markets outperform. The reporting season now under way will test EPS growth and, more importantly, capex. In the US, we are concerned about concentration risks, political uncertainty, and misallocation of capital in the AI space. These risks do not justify the current valuations that markets are demanding.

We reaffirm our conviction in diversifying away from the US and AI hyperscalers towards structural stories such as Japan, EM and Europe. Overall, we aim to benefit from volatility when presented with a good balance between valuations and earnings potential.

Developed Markets

Emerging Markets

MULTI-ASSET

Strengthen safeguards, finetune risk

Francesco SANDRINI

CIO Italy & Global Head of Multi-Asset

John O’TOOLE

Global Head - CIO Solutions

The economic backdrop in the US and Europe is reasonable, but there are indications of slowing US labour markets when valuations are high across many asset classes. Additionally, recent geopolitical newsflow underscores the need for caution, with an overall mild pro-risk stance. Our positive views on equities and credit are supported by a solid profit cycle, robust momentum, and ample liquidity. Specifically, we explore areas of value in EM, and would like to underscore the need to amplify safeguards through gold and reinforce hedges in US and European risk assets.

While we are positive on equities through the Europe, the UK and US, we have carefully upgraded our stance on EM by turning positive on LatAm. In general, LatAm offers attractive relative valuations compared with the rest of the EM. Brazil, the region’s largest economy, is in a monetary-easing cycle; this, coupled with expectations of strong earnings this year, should be positive for Brazilian equities.

We are constructive on US (5Y) and EU (10Y) duration. In the US, weakness in labour markets is combined with a limited pass through of higher tariffs to inflation. We remain positive on USTs due to potential weakness in growth or corporate earnings, and any tightening of financial conditions but have hedged this view through derivatives. We also continue to prefer Italian BTPs over the Bunds, but are cautious on JGBs as fiscal pressures persist. Corporate credit in EU IG is likely to show robust demand.

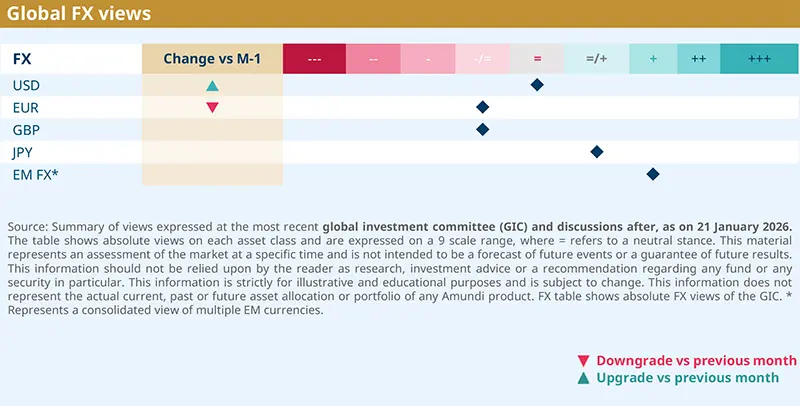

In commodities, we have become more constructive on gold. While medium term catalysts persist, now an increased preference for physical deliveries of gold over derivatives signal market expectations of stress. On oil, however, we have turned cautious amid limited price support from OPEC. In FX, we are positive on NOK and JPY vs the EUR. BoJ rates normalisation could trigger a JPY rally, whereas high inflation in Norway should prevent the central bank from reducing rates.

"We have raised our stance marginally on emerging market equities, and upgraded gold due to higher geopolitical tensions and benefit from its stability".

VIEWS

Amundi views by asset classes

IMPORTANT INFORMATION

The MSCI information may only be used for your internal use, may not be reproduced or disseminated in any form and may not be used as a basis for or a component of any financial instruments or products or indices. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each other person involved in or related to compiling, computing or creating any MSCI information (collectively, the “MSCI Parties”) expressly disclaims all warranties (including, without limitation, any warranty of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose) with respect to this information. Without limiting any of the foregoing, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including, without limitation, lost profits) or any other damages. (www.mscibarra.com).

The Global Industry Classification Standard (GICS) SM was developed by and is the exclusive property and a service mark of Standard & Poor's and MSCI. Neither Standard & Poor's, MSCI nor any other party involved in making or compiling any GICS classifications makes any express or implied warranties or representations with respect to such standard or classification (or the results to be obtained by the use thereof), and all such parties hereby expressly disclaim all warranties of originality, accuracy, completeness, merchantability or fitness for a particular purpose with respect to any of such standard or classification. Without limiting any of the forgoing, in no event shall Standard & Poor's, MSCI, any of their affiliates or any third party involved in making or compiling any GICS classification have any liability for any direct, indirect, special, punitive, consequential or any other damages (including lost profits) even if notified of the possibility of such damages.

This document is solely for informational purposes. This document does not constitute an offer to sell, a solicitation of an offer to buy, or a recommendation of any security or any other product or service. Any securities, products, or services referenced may not be registered for sale with the relevant authority in your jurisdiction and may not be regulated or supervised by any governmental or similar authority in your jurisdiction. The information contained in this document must not be altered or presented in a way that could give rise to misunderstanding or misrepresentation. Any use, reproduction, or distribution of the document’s content without full and proper reference to the original source is prohibited. Any information contained in this document may not be used as a basis for or a component of any financial instruments or products or indices. Furthermore, nothing in this document is intended to provide tax, legal, or investment advice. Unless otherwise stated, all information contained in this document is from Amundi Asset Management S.A.S. and is as of 23 January 2026. Diversification does not guarantee a profit or protect against a loss. This document is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The views expressed regarding market and economic trends are those of the author and not necessarily Amundi Asset Management S.A.S. or Amundi-Acba Asset Management CJSC and are subject to change at any time based on market and other conditions, and there can be no assurance that countries, markets or sectors will perform as expected. These views should not be relied upon as investment advice, a security recommendation, or as an indication of trading for any Amundi or Amundi-Acba product. Investment involves risks, including market, political, liquidity and currency risks. Furthermore, in no event shall Amundi or Amundi-Acba have any liability for any direct, indirect, special, incidental, punitive, consequential (including, without limitation, lost profits) or any other damages due to its use.

Date of first use: 23 January 2026.

"AMUNDI-ACBA ASSET MANAGEMENT" CJSC is a legal entity registered in Armenia, who, based on the Investment fund management license number 0002, provided by the Central Bank of Armenia, carries out mandatory pension fund management activities in Armenia. The registered office is located 10 Vazgen Sargsyan street, Premises 100-101, Yerevan, Armenia.

For more information about Amundi-Acba you can visit www.amundi-acba.am or call 011-310-000.