A breather after buoyant markets

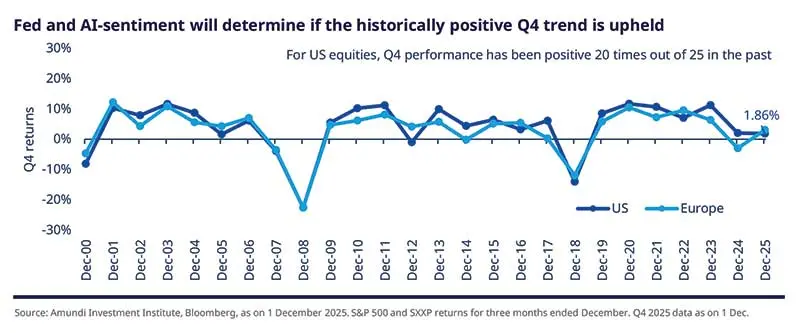

The year is drawing to a close with most risk assets in positive territory, and global stocks and metal prices seeing multiple highs. Even the longest US government shutdown in history didn’t curb market enthusiasm. We think markets have been looking through the weakness in the belief that monetary and fiscal policy levers will be available for support, that profitability of AI investments is almost a given, and that corporate earnings will continue to exceed expectations, following a strong results season in the US, somewhat less so in Europe. The tariffs’ impact on consumption is also largely being ignored.

However, recent concerns over artificial intelligence-led euphoria in the US affirm our stance. We maintain our view that AI capex is boosting the US economy, but is not leading to job creation. Furthermore, while monetary and fiscal support may stabilise the economy, risks in the form of fiscal dominance and financial repression persist. In particular,

"In an environment of high valuations and scrutiny of AI-investments, we are particularly interested in seeing an improvement in productivity and earnings".

In a world where US growth is slowing, but not sharply, stock valuations are high, yet opportunities remain; diversification away from concentrated segments and towards higher income asset classes is the name of the game. This is complemented by challenges to US exceptionalism, which we expect to be reflected in a weakening dollar over the long term.

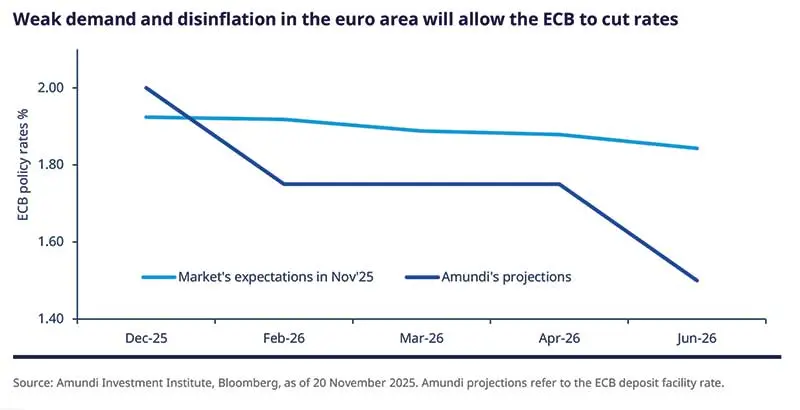

"While we have upgraded our growth expectations for the eurozone for this year, we think domestic demand will be weak and this along with disinflation may lead the ECB to reduce policy rates twice next year".

Monica DEFEND

Head of Amundi Investment Institute & Chief Strategist

Our main asset class convictions are highlighted below:

"We believe investors should remain well-diversified with a moderately risk-on stance, which captures value across different regions in Europe, Japan, and emerging markets".

FIXED INCOME

Agile duration: evolving inflation, policy

Amaury D’ORSAY

Head of Fixed Income

Economic growth in Europe is being affected by a cautious consumer, even as we expect disinflation to continue. Headline inflation in the EZ is likely to be below the ECB target by the year-end. Both these should lead the ECB to reduce policy rates. In the US, fiscal impulse amid US mid-term elections next year could put some pressure on the markets there.

The fiscal side is also in focus in the UK as the government tries to plug the gap between its revenues and expenses. Any fiscal tightening would affect growth expectations. Our steepening bias remains across the developed world except in Japan. Overall, we look for opportunities across yield curves, in DM, as well as EM in the search for higher income.

Duration and yield curves

Credit and EM bonds

FX

EQUITIES

Valuations favour a global approach

Barry GLAVIN

Head of Equity Platform

Equities have delivered strong returns this year to-date mainly due to both positive sentiment around AI and robust corporate earnings, despite mixed signals on economic activity in the US and Europe. Now, the primary question for us is how much of the good news is priced into valuations. Elevated levels increase the potential for a reversal if revenues or margins disappoint. Thus, any volatility before year end or next year beginning may present opportunities in quality businesses that benefit from structural growth drivers.

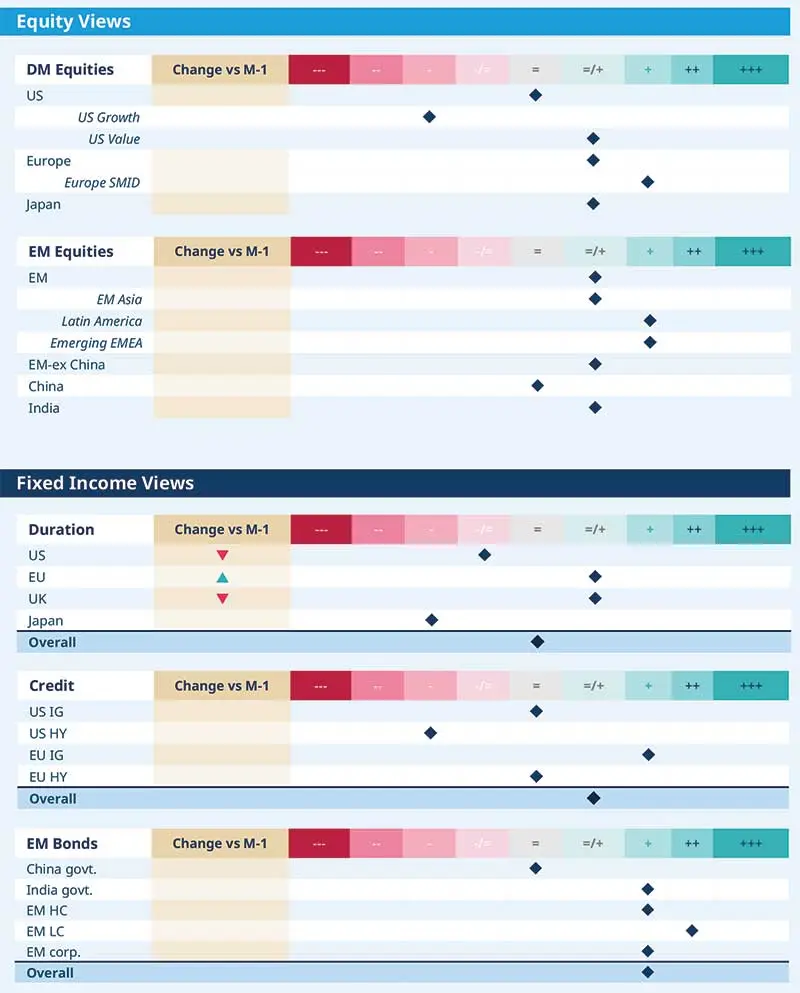

We see such businesses for instance in Europe, the UK and Japan and the emerging markets. European fiscal and monetary policy and Japanese corporate reforms, together with a focus on attractive valuation multiples in the UK and small cap, remain important themes for us.

Developed Markets

Emerging Markets

MULTI-ASSET

Adopt a more balanced stance on risk

Francesco SANDRINI

CIO Italy & Global Head of Multi-Asset

John O’TOOLE

Global Head - CIO Solutions

"Changing earnings dynamics in US mid caps and valuation concerns in the large caps have led us to partly shift our positive view on the US towards European equities".

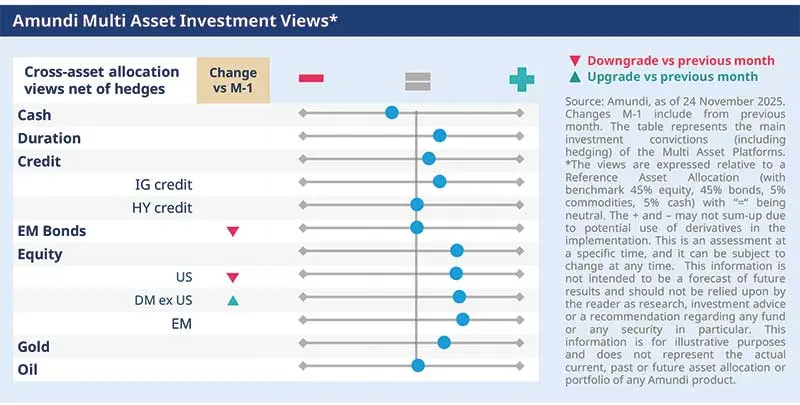

In this current phase of a late-cycle economy, we are witnessing nuanced backdrops across different regions, even as global competition between the US and China continues. For instance, in Europe, economic growth will likely be decent but below potential, US consumption stays fine for now, but a softening labour market means this cannot be sustained. Thus, we are adapting our allocation stance to these nuances, and are looking for value across asset classes. In doing so, we keep a diversified stance towards regions where earnings, valuations and macro environment provide a good risk-reward. Thus, we stay risk- on, with mild adjustments, safeguards, and a positive view on gold.

We are constructive on equities, and see higher potential to play the diversification trend towards regions outside the US, following the strong market movements this year. We closed our positive stance on US mid caps because of weakening earnings dynamics and potential volatility around Fed rate cuts. Additionally, we reduced our constructive view on the S&P 500 owing to both valuation concerns and exuberance in AI-related names. In contrast, we stay positive on the UK and have turned optimistic on Europe owing to its valuations and strong earnings expectations going into next year. We continue to like EM in general and Chinese equities in particular.

In fixed income, we are slightly positive on duration overall, and also keep a positive stance on Italian BTPs (versus Bunds). Italy’s political stability and efforts to stabilise its debt trajectory affirm our stance. In credit, EU IG displays strong corporate fundamentals and technicals. EM bonds spreads have already tightened significantly; thus, we have tactically downgraded them. We reiterate that negative catalysts for EM are limited and financial conditions in general remain favourable.

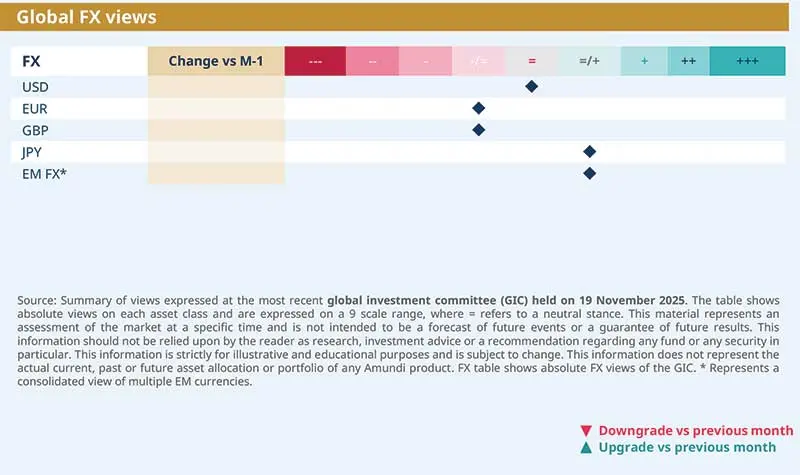

In FX, we are positive on EUR/USD, and on NOK and JPY vs the EUR. While structural drivers will likely weigh on the dollar, the NOK (in risk-on phase) and yen (normalisation by BoJ) should do well against euro.

VIEWS

Amundi views by asset classes

IMPORTANT INFORMATION

The MSCI information may only be used for your internal use, may not be reproduced or disseminated in any form and may not be used as a basis for or a component of any financial instruments or products or indices. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each other person involved in or related to compiling, computing or creating any MSCI information (collectively, the “MSCI Parties”) expressly disclaims all warranties (including, without limitation, any warranty of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose) with respect to this information. Without limiting any of the foregoing, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including, without limitation, lost profits) or any other damages. (www.mscibarra.com).

The Global Industry Classification Standard (GICS) SM was developed by and is the exclusive property and a service mark of Standard & Poor's and MSCI. Neither Standard & Poor's, MSCI nor any other party involved in making or compiling any GICS classifications makes any express or implied warranties or representations with respect to such standard or classification (or the results to be obtained by the use thereof), and all such parties hereby expressly disclaim all warranties of originality, accuracy, completeness, merchantability or fitness for a particular purpose with respect to any of such standard or classification. Without limiting any of the forgoing, in no event shall Standard & Poor's, MSCI, any of their affiliates or any third party involved in making or compiling any GICS classification have any liability for any direct, indirect, special, punitive, consequential or any other damages (including lost profits) even if notified of the possibility of such damages.

This document is solely for informational purposes. This document does not constitute an offer to sell, a solicitation of an offer to buy, or a recommendation of any security or any other product or service. Any securities, products, or services referenced may not be registered for sale with the relevant authority in your jurisdiction and may not be regulated or supervised by any governmental or similar authority in your jurisdiction. The information contained in this document must not be altered or presented in a way that could give rise to misunderstanding or misrepresentation. Any use, reproduction, or distribution of the document’s content without full and proper reference to the original source is prohibited. Any information contained in this document may not be used as a basis for or a component of any financial instruments or products or indices. Furthermore, nothing in this document is intended to provide tax, legal, or investment advice. Unless otherwise stated, all information contained in this document is from Amundi Asset Management S.A.S. and is as of 30 November 2025. Diversification does not guarantee a profit or protect against a loss. This document is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The views expressed regarding market and economic trends are those of the author and not necessarily Amundi Asset Management S.A.S. or Amundi-Acba Asset Management CJSC and are subject to change at any time based on market and other conditions, and there can be no assurance that countries, markets or sectors will perform as expected. These views should not be relied upon as investment advice, a security recommendation, or as an indication of trading for any Amundi or Amundi-Acba product. Investment involves risks, including market, political, liquidity and currency risks. Furthermore, in no event shall Amundi or Amundi-Acba have any liability for any direct, indirect, special, incidental, punitive, consequential (including, without limitation, lost profits) or any other damages due to its use.

Date of first use: 30 November 2025.

"AMUNDI-ACBA ASSET MANAGEMENT" CJSC is a legal entity registered in Armenia, who, based on the Investment fund management license number 0002, provided by the Central Bank of Armenia, carries out mandatory pension fund management activities in Armenia. The registered office is located 10 Vazgen Sargsyan street, Premises 100-101, Yerevan, Armenia.

For more information about Amundi-Acba you can visit www.amundi-acba.am or call 011-310-000.