Central banks easing into a thus-far resilient economy

The year gone by has been exceptional in some respects. Global equities touched new highs, and emerging market stocks reached close to their 2021 levels. All this happened despite the US administration’s somewhat unconventional policies, particularly on the trade front, leading to a phenomenal performance of safe-haven gold.

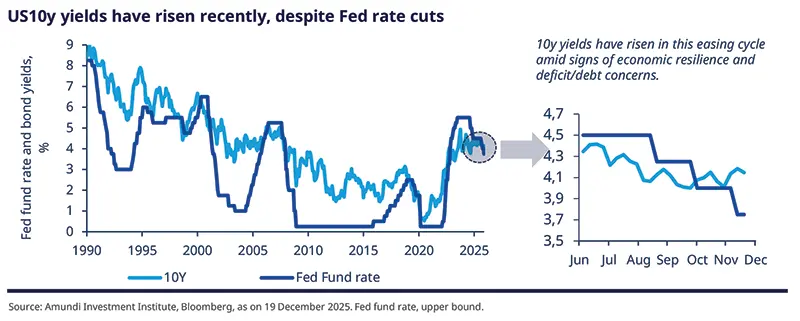

The fact that assets at both ends of the risk spectrum delivered strong returns is remarkable. More recently, European and Japanese bond yields rose. Interestingly, US yields have risen despite the Fed’s rate-cut cycle. Although the long end of the yield curve is less affected by monetary policy decisions (versus the short end), it is still unusual for both to move in opposite directions.

Looking ahead, fiscal policy is likely to do the heavy-lifting, particularly in the US, Germany, and Japan, with monetary policy also expected to provide support. Hence, consumption, labour markets, and the inflation environment will drive policy decisions, while artificial intelligence (AI)-related investments will attract greater market scrutiny. All this will happen along with challenges to US exceptionalism:

"The unorthodox policies of the Trump administration and pressures on the Fed mean real yields in the US are likely to be capped, which would diminish the greenback’s safe haven appeal"․

Monica DEFEND

Head of Amundi Investment Institute & Chief Strategist

"Both macro liquidity (balance sheet expansion, money supply etc.) and market liquidity are sufficient, but could dry fast in case of policy uncertainty and high volatility. This supports our moderate risk stance". (1)

Vincent MORTIER

Group Chief Investment Officer

(1) Market liquidity is derived from trading activity and signifies how quickly a security can be bought or sold without significantly affecting prices.

Risks related to high debt and widening deficits in the developed world, and global geopolitics will persist. In this environment, emerging markets present a strong case for idiosyncratic opportunities, particularly as DM central banks ease policies. We describe our investment convictions in detail below:

"Concerns about weakening US labour markets and high risk-asset valuations are balanced by fiscal and monetary support, and abundant liquidity. Against this not so straightforward backdrop, we have slightly reduced our pro-risk stance".

Philippe D'ORGEVAL

Deputy Group Chief Investment Officer

FIXED INCOME

Neutral duration with regional divergences

Amaury D’ORSAY

Head of Fixed Income

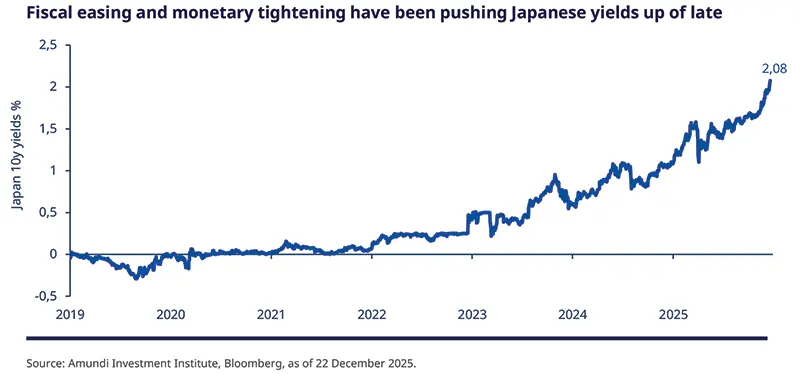

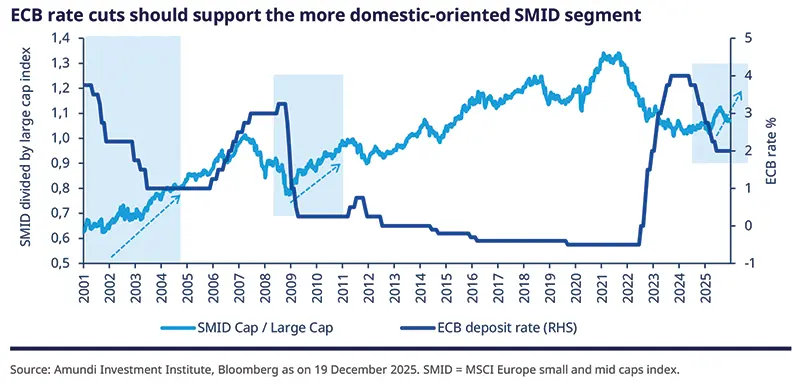

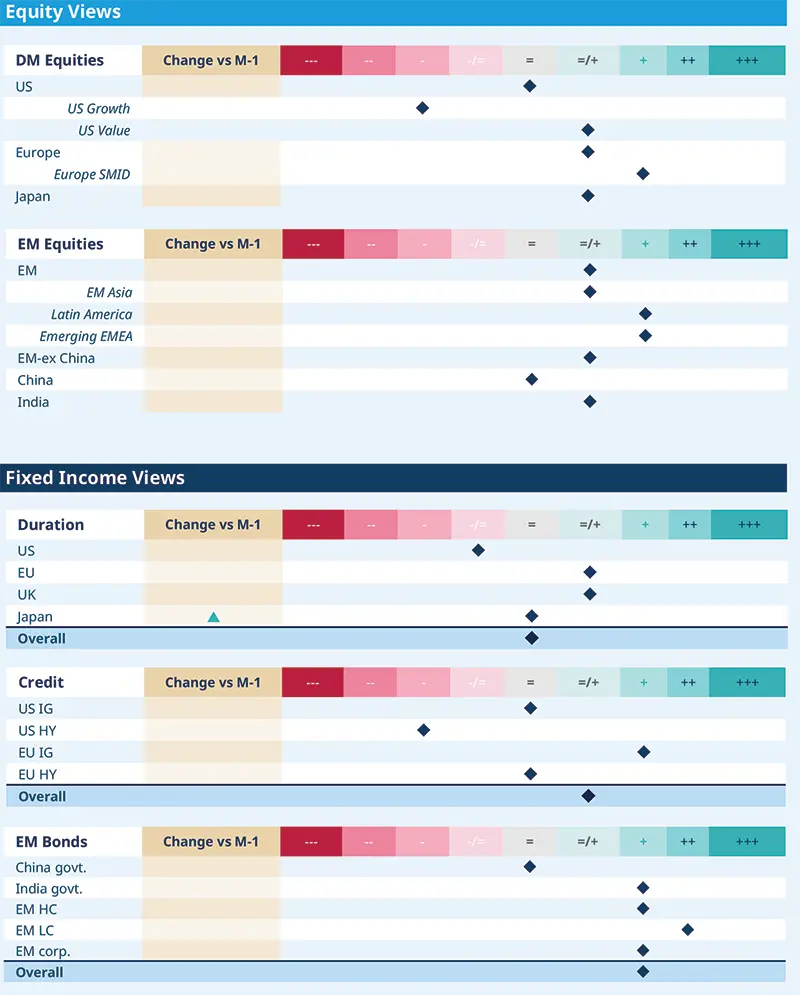

While the global economy has been reasonably resilient, there are some minor nuances across the main regions. For instance, in the EZ, wage inflation is low, and overall disinflation looks on track. Our expectations of ECB rate cuts in 2026 remain, despite recent hawkish comments from some board members. In Japan, a key question for us is at what yield-level Japanese debt becomes sufficiently attractive, and how much further fiscal easing is likely from the government.

In this environment, we prefer to play across geographies in the search for stability and additional yields. For the latter, we find opportunities in corporate credit and EM bonds (also good from a diversification perspective) that are a source of high-quality yields.

Duration and yield curves

Credit and EM bonds

Corporate credit is driving the market’s hunt for yield and high quality. In EU IG, the financials sector is attractive with its high capital buffers and profitability. In HY, where we are neutral, select names in telecom and financials offer good value.

We are positive on EM bonds but acknowledge expensive valuations in some segments. We like LC debt in Brazil, Mexico, Hungary and India, where yields are attractive, and disinflation is ongoing.

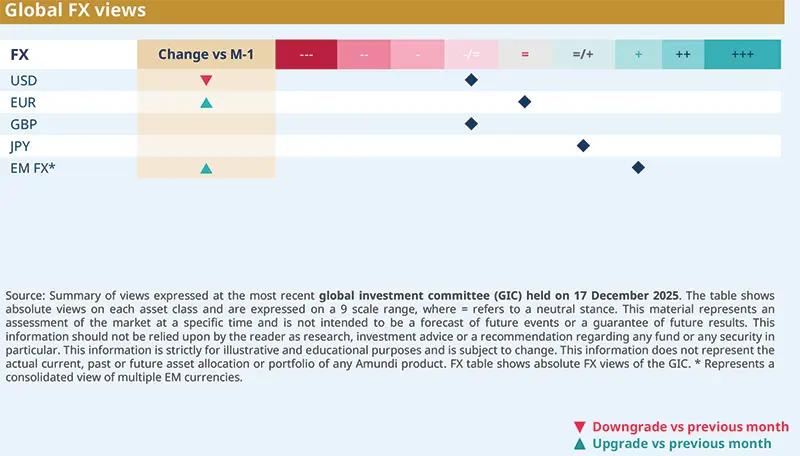

FX

In FX, we downgraded the US dollar to cautious due to negative seasonality around the year-end, and fading US exceptionalism. Fed is not in a hiking mode, and tariffs remain a source of uncertainty.

On EM FX, we are slightly more positive. We prefer high-yielding FX such as the BRL and the TRY. Any positive sentiment from progress on a Russia–Ukraine agreement could be reflected in the FX of some eastern European currencies, such as the PLN.

EQUITIES

Diversify with small and mid cap in Europe

Barry GLAVIN

Head of Equity Platform

The global economy has played out reasonably well, and that’s being reflected in market performance amid ample liquidity. What’s not reflected in the markets is policy uncertainty, signs of consumption slowing down, and risks of high valuations. In this environment, our focus remains on fundamentals and staying tilted towards businesses where risk-reward is well balanced. Increasingly, we find such businesses in regions outside the US.

For instance, Europe is making strong commitment to high public spending and to onshoring strategic supply chains. Additionally, in emerging markets, our positive view is reinforced by this year’s outperformance versus the developed world. Overall, we maintain our barbell approach, with a positive stance on quality industrials and defensive sectors.

Developed Markets

Emerging Markets

MULTI-ASSET

Risk-on: recalibrate, but not retreat

Francesco SANDRINI

CIO Italy & Global Head of Multi-Asset

John O’TOOLE

Global Head - CIO Solutions

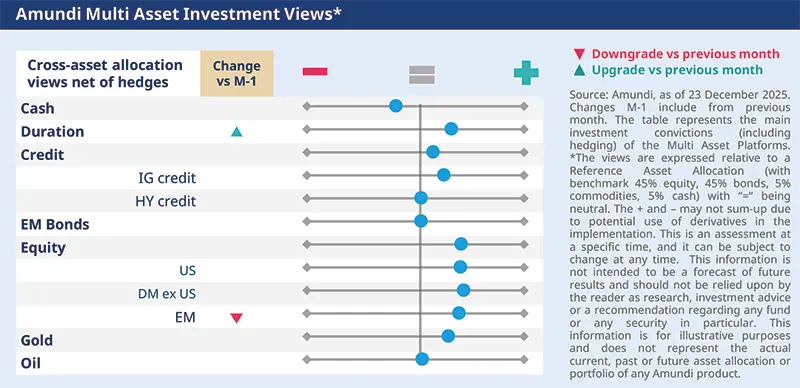

We are seeing mixed macro signals in the US. Job markets are deteriorating, but the pace (of deterioration) is stabilising, the Fed is easing and is conscious of maintaining liquidity, and fiscal policy is supportive. In Europe, consumption is subdued, but inflation is declining. These factors, combined with strong liquidity and benign credit conditions in the markets, somewhat offset (but not completely eliminate) the risks posed by high valuations. Hence, we made some adjustments to our views on risk assets, without changing our medium- term stance. In addition, we maintain that safeguards in the form of gold and hedges on DM equities are essential amid high valuations.

Our views on equities are optimistic, including on the US, UK and EU. Fed easing and earnings are supportive. But markets would increasingly scrutinise the return potential from companies’ capex in AI and in the broader US tech sector. In EM, we are seeing a deterioration in China’s domestic sentiment, when valuations are stretched, leading us to tactically move to neutral on China. We continue to monitor the economic environment there. We’d like to stay more balanced through a positive view on the broader EM, which includes China.

We maintain our constructive view on duration mainly through the US and Europe, but have reduced our negative view on Japan following the rapid rise in yields in recent months driven by the BOJ’s intent to normalise policy. But we are still cautious on Japan. In the US, we think the short-end and the middle of the yield curves are more attractive vs the long end. In Europe, we see lower rates going forward as growth is a bit fragile. We are also positive on Italian BTPs vs the bund. We continue to seek value in EU IG as well as EM bonds.

Our FX views rely on structural challenges to the USD. Additionally, we are positive on NOK and JPY vs the EUR. The NOK would be supported by Norway’s cyclical exposure at a time of decent global growth.

"We’ve moved to a more balanced stance on EM equities, reflecting the strong movements, while on duration we have tactically recalibrated our views on Japan".

VIEWS

Amundi views by asset classes

IMPORTANT INFORMATION

The MSCI information may only be used for your internal use, may not be reproduced or disseminated in any form and may not be used as a basis for or a component of any financial instruments or products or indices. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each other person involved in or related to compiling, computing or creating any MSCI information (collectively, the “MSCI Parties”) expressly disclaims all warranties (including, without limitation, any warranty of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose) with respect to this information. Without limiting any of the foregoing, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including, without limitation, lost profits) or any other damages. (www.mscibarra.com).

The Global Industry Classification Standard (GICS) SM was developed by and is the exclusive property and a service mark of Standard & Poor's and MSCI. Neither Standard & Poor's, MSCI nor any other party involved in making or compiling any GICS classifications makes any express or implied warranties or representations with respect to such standard or classification (or the results to be obtained by the use thereof), and all such parties hereby expressly disclaim all warranties of originality, accuracy, completeness, merchantability or fitness for a particular purpose with respect to any of such standard or classification. Without limiting any of the forgoing, in no event shall Standard & Poor's, MSCI, any of their affiliates or any third party involved in making or compiling any GICS classification have any liability for any direct, indirect, special, punitive, consequential or any other damages (including lost profits) even if notified of the possibility of such damages.

This document is solely for informational purposes. This document does not constitute an offer to sell, a solicitation of an offer to buy, or a recommendation of any security or any other product or service. Any securities, products, or services referenced may not be registered for sale with the relevant authority in your jurisdiction and may not be regulated or supervised by any governmental or similar authority in your jurisdiction. The information contained in this document must not be altered or presented in a way that could give rise to misunderstanding or misrepresentation. Any use, reproduction, or distribution of the document’s content without full and proper reference to the original source is prohibited. Any information contained in this document may not be used as a basis for or a component of any financial instruments or products or indices. Furthermore, nothing in this document is intended to provide tax, legal, or investment advice. Unless otherwise stated, all information contained in this document is from Amundi Asset Management S.A.S. and is as of 30 November 2025. Diversification does not guarantee a profit or protect against a loss. This document is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The views expressed regarding market and economic trends are those of the author and not necessarily Amundi Asset Management S.A.S. or Amundi-Acba Asset Management CJSC and are subject to change at any time based on market and other conditions, and there can be no assurance that countries, markets or sectors will perform as expected. These views should not be relied upon as investment advice, a security recommendation, or as an indication of trading for any Amundi or Amundi-Acba product. Investment involves risks, including market, political, liquidity and currency risks. Furthermore, in no event shall Amundi or Amundi-Acba have any liability for any direct, indirect, special, incidental, punitive, consequential (including, without limitation, lost profits) or any other damages due to its use.

Date of first use: 30 November 2025.

"AMUNDI-ACBA ASSET MANAGEMENT" CJSC is a legal entity registered in Armenia, who, based on the Investment fund management license number 0002, provided by the Central Bank of Armenia, carries out mandatory pension fund management activities in Armenia. The registered office is located 10 Vazgen Sargsyan street, Premises 100-101, Yerevan, Armenia.

For more information about Amundi-Acba you can visit www.amundi-acba.am or call 011-310-000.