What happened in Venezuela?

Following a targeted US military operation, Nicolás Maduro and his wife were exfiltrated from the country and transferred to New York to face long-standing narco-terrorism charges. The capture itself reportedly did not involve extensive firefights, having been carefully planned to enable the safe insertion and extraction of US Delta Force and other units. Despite the dramatic headline, Maduro’s inner circle remains largely intact: the Defence Minister’s death was denied, and Vice President Delcy Rodríguez has stepped in as the new formal leader.

"The targeted US operation in Venezuela achieved its primary goal —the ousting of Maduro — without escalating into a wider military engagement".

How is the political picture likely to evolve?

The situation remains largely uncertain. At this stage, the most probable near-term outcome is a managed transition, with so far little meaningful disruption to Venezuela’s domestic power structure. The Vice President has now formally assumed leadership, with the rest of the cabinet remaining largely intact.

In a recent press conference, President Trump made it clear that he does not believe the opposition is prepared to govern the country. Instead, he stated that the US will take an active role in managing Venezuela’s affairs alongside local partners. Trump emphasised that the US will “run it properly” and “professionally,” with plans to bring in some of the largest oil companies to invest billions of dollars — an investment that will also translate into extracting substantial revenues. In a statement released on Sunday, Vice President Delcy Rodríguez invited “the US government to work together on a cooperation agenda, aimed at shared development, within the framework of international law, and to strengthen lasting community coexistence.”

This apparent continuity, however, masks real risks: elite competition, questions about military loyalty, and the likelihood of heightened anti-US sentiment as Washington asserts influence.

What are the geopolitical implications?

International reactions are already shaping the geopolitical backdrop. Russia and Brazil have condemned the operation, while China has adopted a more cautious stance. EU governments and institutions have criticised the violation of international law, albeit in a fragmented manner, and have largely refrained from directly challenging President Trump.

Trump is broadening his policy toolkit to achieve geopolitical goals, including regime change, which is something he condemned in the past. The US president’s willingness to engage in unorthodox military undertakings is likely to strengthen US deterrence. The operation will likely heighten concerns in Russia and China over America’s readiness to intervene militarily. European leaders are now increasingly uneasy about Trump’s Greenland ambitions, while Latin American leaders are most concerned — Mexico and Colombia have already received warnings. Cuba has returned on the radar with the possibility of an oil embargo.

"The targeted US operation in Venezuela achieved its primary goal —the ousting of Maduro — without escalating into a wider military engagement".

What is the impact on oil?

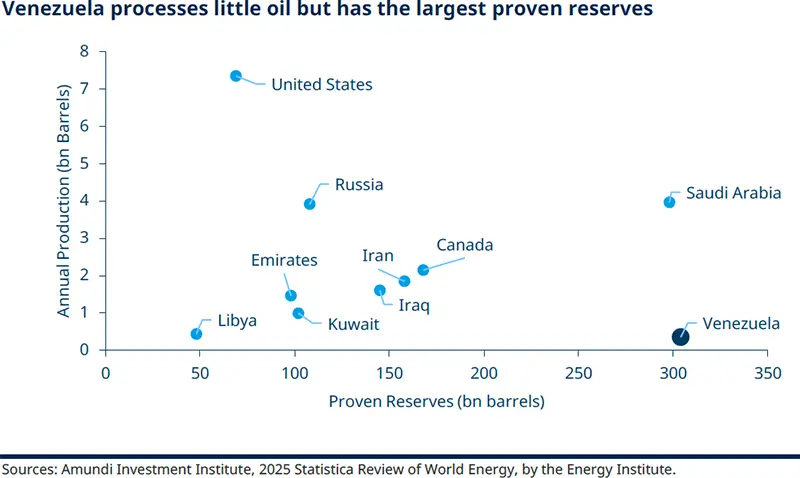

There is likely to be some uncertainty around the oil market impact. A key US motivation for removing Maduro was to secure access to Venezuelan oil for US firms; however, any meaningful increase in supply will take time. The country currently produces around 1 million barrels of oil per day. Venezuela’s history of seizing company assets means Western firms not already present will likely be reluctant to invest until the new power structures and security situation become clearer.

Therefore, for oil markets, the short‑term price impact is likely to be limited. Near‑term upside from supply disruption is constrained by the small contribution of Venezuela’s oil to the global supply, while the medium term could see downward pressure if Venezuelan output is materially restored and added to global supply. For the dollar and broader capital flows, tighter US control over Venezuelan oil bolsters the strategic case for the USD, but uncertain foreign policy actions can erode confidence in US partnership predictability — a subtle risk that could, over time, influence investors’ allocation decisions toward US assets.

"In the short term, oil market impacts are likely to be limited due to Venezuela’s currently low production levels and the logistical and investment constraints hindering any significant increase".

What will be the impact on Venezuelan sovereign debt?

For bondholders and creditors, Maduro’s removal triggers a reassessment of the recovery value, even though it does not necessarily lead to an imminent debt restructuring. Assuming a stable political transition, there is further upside to Venezuelan bond prices. The key variable is future oil cash flow: Venezuela currently produces around 1.0 million barrels per day, and the scenarios that matter for creditors are those that credibly restore production and permit large capex. Optimistic projections of 2.5–3.0 million b/d over several years are possible but require sustained investment, security, and legal clarity. Any meaningful restructuring will also be complicated by significant bilateral claims from China and Russia.

How is the market reacting?

Despite being the country with the largest proven oil reserves, Venezuela’s low oil production and its small weight in the global economy mean that the direct economic impact of the recent developments is not a major driver for markets. Yet, the perception of a quicker geopolitical realignment is rising, with gold moving higher after previous sessions’ profit-taking. The recent events do not change the overall outlook, which remains one of resilient growth but with multiple risks — from geopolitics to rising debt and high valuations — calling for a balanced stance with a slightly positive view on risky assets, and diversification across regions, including emerging markets, and across sectors.