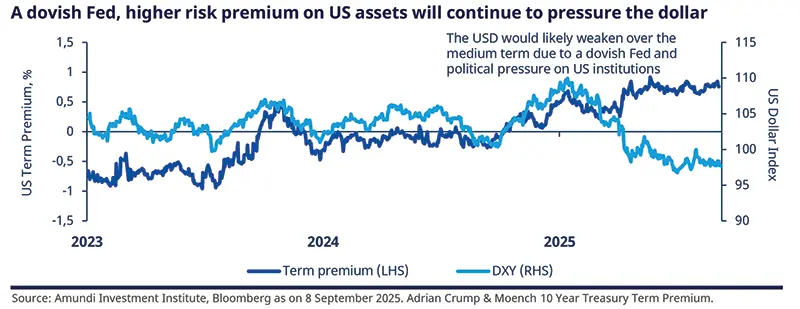

US equities touched new highs in August and European markets traded close to their March levels, while corporate credit spreads compressed over the summer. Sentiment was led by expectations for AI capital expenditure, a strong US earnings season, and a relatively dovish Fed at Jackson Hole. Markets seems to be ignoring the risks around economic activity (e.g., labour markets), political pressure on the Fed, fiscal deficits, and corporate margins.

We believe the themes below are likely to drive the markets now:

Inflation pressure is likely to be transitory, but may not materialise all at once (ie, service vs goods). Growth will remain in a soft patch this year and in 2026 due to a cooling labour market and slowing wage growth (not yet visible clearly). Higher near-term inflation will also weigh on consumption for the rest of the year. Also, the Eurozone will be affected by tariffs, but the ECB will continue its support. Growth in the second half of the year will be weaker than in the first half of the year. Nonetheless, domestic demand is holding up, supported by real wage growth, but export risks are high.

Overall, we maintain our projections of three rate cuts this year (the first in September) by the Fed, driven by a weakening economy as the Fed shifts its focus toward employment. The ECB will likely remain data-dependent and open to rate cuts in the coming months.

"A higher risk premium on US assets (dollar, Treasuries) will have implications for portfolio construction, given their traditional role in asset allocation"․

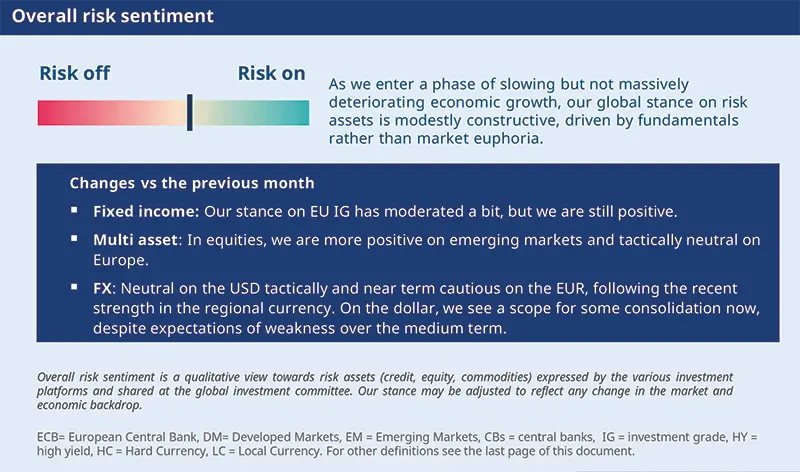

To summarise, high debt levels in the developed world, political pressure on US institutions, and the need for more policy action in Europe will keep the markets’ attention, whereas in emerging countries, the growth story is selectively improving. We also note complacent US markets, which are looking the other way from the risks on our radar. This backdrop allows us to maintain our mildly risk-on stance.

Amundi Investment Institute: Yield curve steepening, corporate earnings in focus

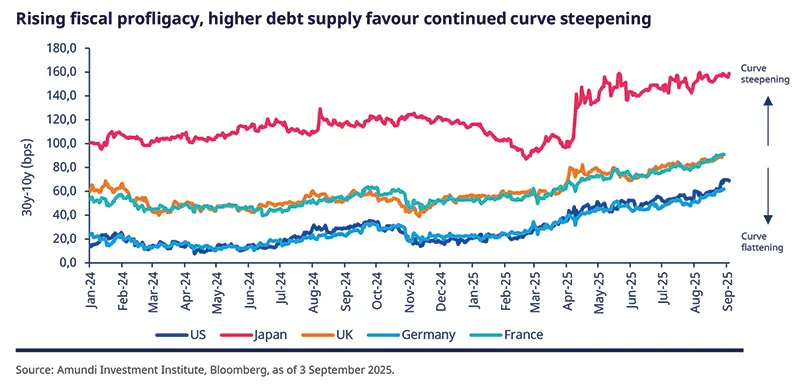

Rising inflation expectations, larger fiscal deficits and higher term premium would put upward pressure on yields at the long end of the curve, whereas monetary easing would lower short end yields. We expect curve steepening to continue across most major developed markets such as the US, Japan, and the UK. In Europe, German fiscal spending plans and reform to pension systems particularly in the Netherlands, will likely pressurise the long end of the curve.

US corporate earnings for the second quarter were much stronger than expected led by the communication services and the information technology sectors.* This pushed the markets further up. Looking ahead, in the very near term, we think market outlook will be driven by macroeconomic factors (labour markets, consumption, and any potential near term push to inflation in the US) and monetary policy.

*Around 95% of companies in the US reported, as of August-end.

"We believe fiscal deficits concerns, inflation expectations and monetary easing will continue to drive yield curve steepening across developed markets, particularly in the US".

Monica DEFEND

Head of Amundi Investment Institute & Chief Strategist

Credit conditions are stable and momentum in the markets is strong, but this could change if disappointment on earnings emerge. We are balanced and slightly positive on risky assets:

"Valuations, potential margin pressure from tariffs in the rest of the year, and below-potential US growth prevent us from raising our stance on risk assets".

FIXED INCOME

Curve steepening amid deficit concerns

Amaury D’ORSAY

Head of Fixed Income

Higher US inflation expectations in the short term, fiscal spending plans in the US and EU (ie, higher bond supply), and continued monetary easing are the main themes we will focus on in the medium term. Collectively, this has led yields in the US, Europe, the UK, and Japan to rise, particularly on the long end of the curve. Additionally, reforms to the pension system in some countries in Europe would further push long term yields upwards.

In the UK, we have our eyes on inflation and the government budget (in November) and whether it can reassure the markets that funding will not be an issue. On the other hand, corporate spreads are tight but we see selective value and attractive carry for instance in European high-quality.

Duration and yield curves

Corporate credit

FX

EQUITIES

Diversify in times of concentration risks

Barry GLAVIN

Head of Equity Platform

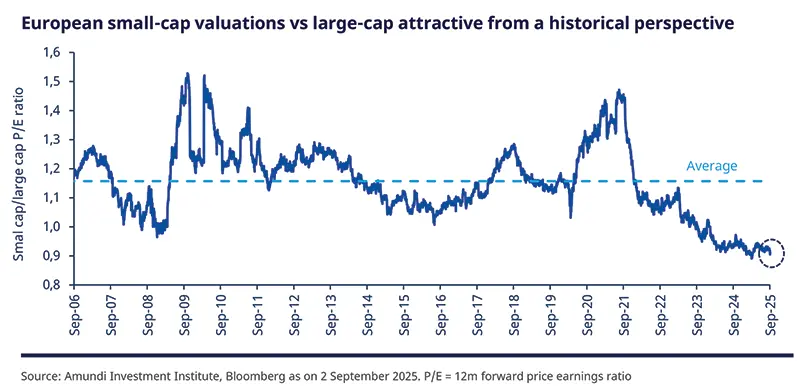

Despite the ongoing geopolitical noise and policy uncertainty, global equity markets continued to climb higher. AI sectors are supporting markets, while hard data is, as yet, showing no signs of impact from tariffs. Corporate earnings were better than expected in the US, but concentration risks are rising. Hence, we favour a continuation of a shift away from the US market towards Europe and Japan.

We believe Europe is better-positioned to mitigate some tariff-related impacts through fiscal and monetary policies. It should also benefit from reforms aimed at enhancing competitiveness at EU level and declining energy costs. Across markets, we expect volatility to persist, and aim to capitalise on any share price weakness among quality stocks. Overall, our preference for balance sheet strength and idiosyncratic risk is retained.

Global convictions

Sector and style convictions

EMERGING MARKETS

EM idiosyncratic stories make a comeback

Yerlan SYZDYKOV

Global Head of Emerging Markets

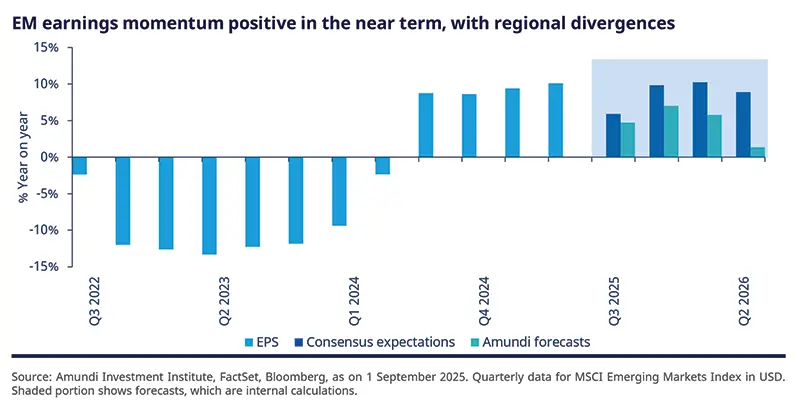

Global emerging markets are displaying a return of country-specific factors – some improvements observed in the economic environment in China (external pressures have abated but domestic demand still weak) and India, whereas politics is coming back in focus in Brazil and Indonesia. However, volatility on the trade front still remains a factor across EM. In countries such as India, internal tax reforms bode well for domestic consumption, which is a mainstay of growth.

Overall, in light of a dovish Fed, global investors should benefit from better growth in EM and positive earnings momentum that will allow them to diversify away from the US. That said, we are monitoring geopolitical risks and developments on the trade front.

EM bonds

EM equities

MULTI-ASSET

Pro-risk stance with a rotation to EM

Francesco SANDRINI

Head of Multi-Asset Strategies

John O’TOOLE

Head of Multi-Asset Investment Solutions

"While maintaining a constructive stance on risk, investors should explore rotation opportunities, such as those in EM, in light of the evolving macro environment".

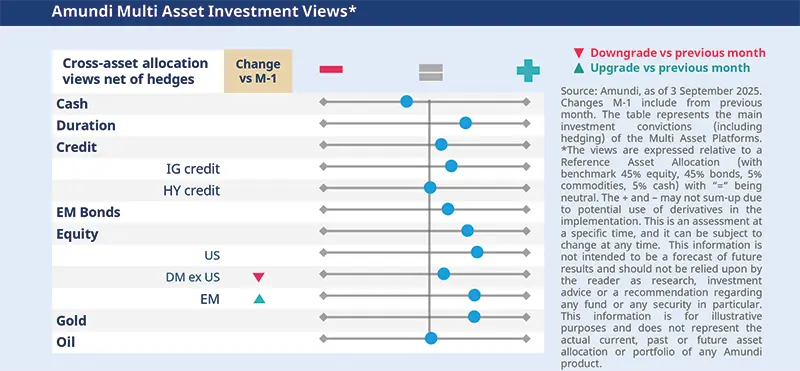

Over the summer, we did not see any extreme macro data coming out of the US or Europe, leading the markets to stay relatively calm. We did, however, note a deterioration in US labour markets even as higher US tariffs were confirmed. Both these should pressure consumption – we affirm our stance of a decelerating growth in US. Monetary policy, on the other hand, looks likely to be accommodative in the EU as well as US. Hence, we are slightly optimistic on risk assets, including EM, and see a need for safeguards in the form of gold (geopolitical risks, fiscal deterioration) and equity hedges.

We are positive on equities, including the US (balanced between large and mid caps) and, slightly on the UK, but have tactically downgraded Europe to neutral (tariffs could weigh on corporate earnings) in order to raise our views on EM. EM offers a wide basket of markets, such as India, and we are more positive on them. They should benefit from a weaker dollar, and a dovish Fed likely to cut rates soon. Second, while we remain positive on China, we have partially shifted our stance from China towards the wider EM. Regulators’ concerns around the sharp market rally in the country could pave way for a short-term correction.

We have been staying positive on DM govt. bonds for many months amid a general disinflation trend and easing central banks. Given the fiscal deficit concerns (eg, in US), we prefer to stay on the intermediate parts of the curve (5Y). We are also positive on Europe and UK duration, and like Italian BTPs. Growth in the UK will likely be below consensus, and the BoE’s decision should support some compression between Gilts and UST. However, on JGBs, we remain cautious. Our mildly constructive stance on EU IG and EM bonds is maintained.

Amid rising concentration risks, we see a bigger need for protections on US equities, and keep our views on other hedges, should there be volatility in risky assets. In FX, are cautious on the USD, but are positive on the NOK and JPY. In EM, we favour LatAm FX over the CNY.

VIEWS

Amundi views by asset classes

IMPORTANT INFORMATION

The MSCI information may only be used for your internal use, may not be reproduced or disseminated in any form and may not be used as a basis for or a component of any financial instruments or products or indices. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each other person involved in or related to compiling, computing or creating any MSCI information (collectively, the “MSCI Parties”) expressly disclaims all warranties (including, without limitation, any warranty of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose) with respect to this information. Without limiting any of the foregoing, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including, without limitation, lost profits) or any other damages. (www.mscibarra.com).

The Global Industry Classification Standard (GICS) SM was developed by and is the exclusive property and a service mark of Standard & Poor's and MSCI. Neither Standard & Poor's, MSCI nor any other party involved in making or compiling any GICS classifications makes any express or implied warranties or representations with respect to such standard or classification (or the results to be obtained by the use thereof), and all such parties hereby expressly disclaim all warranties of originality, accuracy, completeness, merchantability or fitness for a particular purpose with respect to any of such standard or classification. Without limiting any of the forgoing, in no event shall Standard & Poor's, MSCI, any of their affiliates or any third party involved in making or compiling any GICS classification have any liability for any direct, indirect, special, punitive, consequential or any other damages (including lost profits) even if notified of the possibility of such damages.

This document is solely for informational purposes. This document does not constitute an offer to sell, a solicitation of an offer to buy, or a recommendation of any security or any other product or service. Any securities, products, or services referenced may not be registered for sale with the relevant authority in your jurisdiction and may not be regulated or supervised by any governmental or similar authority in your jurisdiction. Any information contained in this document may only be used for your internal use, may not be reproduced or redisseminated in any form and may not be used as a basis for or a component of any financial instruments or products or indices. Furthermore, nothing in this document is intended to provide tax, legal, or investment advice. Unless otherwise stated, all information contained in this document is from Amundi Asset Management S.A.S. and is as of 7 September 2025. Diversification does not guarantee a profit or protect against a loss. This document is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The views expressed regarding market and economic trends are those of the author and not necessarily Amundi Asset Management S.A.S. and are subject to change at any time based on market and other conditions, and there can be no assurance that countries, markets or sectors will perform as expected. These views should not be relied upon as investment advice, a security recommendation, or as an indication of trading for any Amundi product. Investment involves risks, including market, political, liquidity and currency risks. Furthermore, in no event shall Amundi have any liability for any direct, indirect, special, incidental, punitive, consequential (including, without limitation, lost profits) or any other damages due to its use. Assumptions on tariffs as of 28 August 2025, countries face value tariffs are adjusted with sectoral tariffs (Section 232) and/or exemptions. On India, 25% Universal tariffs and 25% secondary sanctions on Russian Oil Imports; on China 20% Fentanyl and 10% reciprocal. Sectoral tariffs on Canada and Mexico only for non-USMCA-compliant imports.

Date of first use: 7 September 2025. DOC ID: 4285688

Document issued by Amundi Asset Management, “société par actions simplifiée”- SAS with a capital of €1,143,615,555 - Portfolio manager regulated by the AMF under number GP04000036 - Head office: 91-93 boulevard Pasteur, 75015 Paris - France - 437 574 452 RCS Paris - www.amundi.com.