Tariffs and fiscal policy, the moment of truth

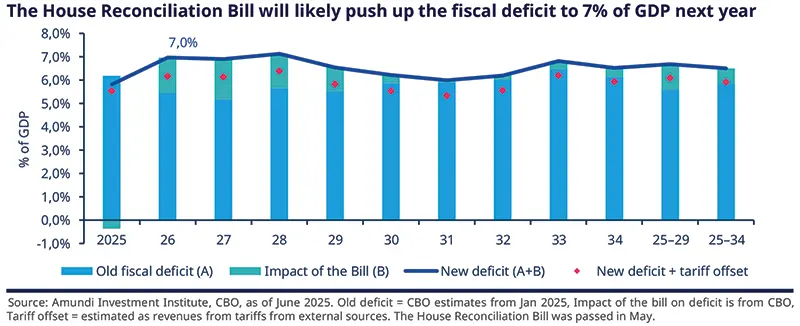

Mounting concerns over large US fiscal deficits, along with consumers’ inflation expectations and the escalating conflict in the Middle East, have started moving the markets. The issues around fiscal sustainability were further aggravated by President Trump’s Big Beautiful Bill, the renewed interest in fiscal expansion in Europe (including German borrowing plans), and Japanese debt auctions. Long-end bond yields rose in response, but equities showed some resilience.

Looking ahead, we could see some signs of weakness. Barring an escalation of the Israel-Iran conflict, markets will now focus on fiscal risks and tariffs. The big question is whether the allure of US assets is diminished by the fiscal issues, the challenge to the status quo by the US administration’s policies, and how that could affect US assets.

We could very well see these old patterns changing in the future, but it is a long-term trend, not something that will happen within a short time frame. For now, trust in US institutions and their credibility remains intact – it may be questioned at various stages though. From an economic perspective, we see the following main themes playing out:

The traditional safe haven stature of the USD will be challenged in an era of rising deficit and debt.

To summarize, we remain marginally positive on risk assets, with increased valuation discipline. Growth-inflation mix is less of a headwind, and we do not see a corporate earnings recession. But fiscal direction and the potential economic impact of uncertainty on tariffs and of geopolitical conflicts point to high volatility.

Amundi Investment Institute: central banks and the dollar

Fed in a wait and see mode, unsurprisingly. We confirm our projections of three Fed rate cuts this year. Economic growth will likely remain below potential and credit and liquidity conditions in the market are also good. However, price hikes due to import tariffs in the US and a sustained surge in oil prices (not our base case) due to the geopolitical tensions in the Middle East might reinforce inflationary pressures. For the ECB and the BoE, we maintain our view of two cuts each this year. For the Bank of Japan, inflation and volatility in yields are major issues. Nonetheless, real yields in the country are still low. Thus, we expect the bank to hike rates once in October this year, and after that, terminal rates should reach 0.75%.*

The dollar is coming under pressure from questions over superiority of US growth, and high US government debt (and deficit). Because of the changing correlations between the dollar and US equities, the currency is not acting as well as a diversifier as it was in the past. Despite all that, near-term consolidation in the dollar is possible for example as a result of stress coming from global conflicts. Hence importantly, any shift away from the greenback is a multi-year trend. We expect the EUR/USD to reach 1.20 by around Q2 next year.

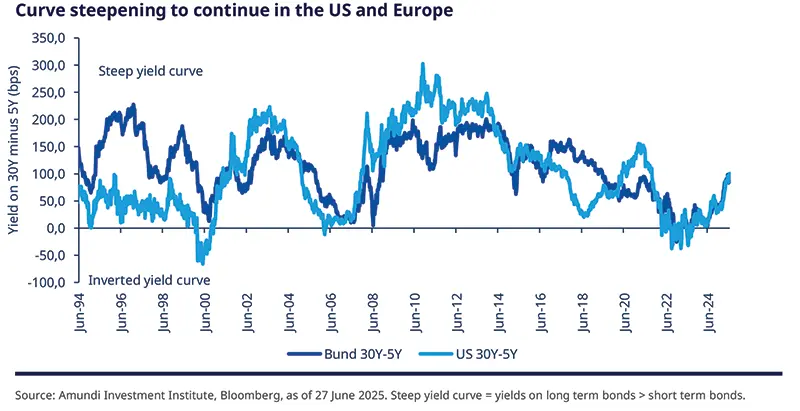

"Debt piling up and deficits rising are common features across the US, Europe and Japan. This will have consequences for the long end of the yield curve, which is likely to come under pressure".

Monica Defend

Head of Amundi Investment Institute & Chief Strategist

In line with our economic backdrop discussed earlier, we outline our main investment convictions below:

"Changing correlations between asset classes is a time to question the historical playbook, particularly in light of high equity valuations".

FIXED INCOME

Curve steepeners are the way forward

Amaury D’ORSAY

Head of Fixed Income

Inflation is easing in developed markets, though tariff effects are still unfolding. Meanwhile, high government debt and spending bills risk pushing yields higher. For instance, the Big Beautiful Bill is feeding concerns over bond vigilantes, particularly at the very long end of the yield curve.

In this fluid environment, we maintain an overall positive and agile duration stance and see curve steepening opportunities in the US and Europe. But regional and tactical nuances require flexibility across the spectrum. Fundamentals in corporate credit are strong, but some deterioration is possible on the low-quality side if growth disappoints. We favour names with strong capital buffers, and less affected by changes to the economic cycle.

Duration and yield curves

Corporate credit

FX

EQUITIES

Prioritize valuations and quality

Barry GLAVIN

Head of Equity Platform

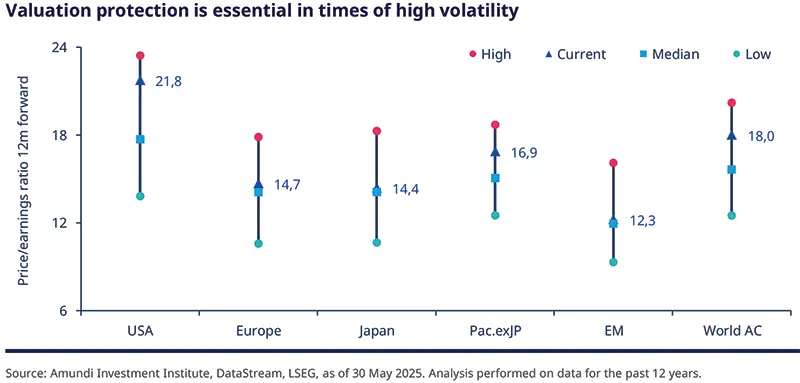

Equities have been resilient so far this year, with Europe outperforming the US, as the full impact of tariff policies has yet to be felt. Corporate forward guidance indicate that the impact of tariffs is still not clear. While some companies with pricing power will be able to raise prices once the impact of tariffs are felt, other will not. This differentiation will be crucial in deciding the impact on margins.

In addition, we think, European market performance so far has not been broad based. Looking ahead, this might change, and the rally could broaden, depending on forward earnings guidance, economic developments, and tariff-related newsflow. Our focus remains on identifying those names through a bottom-up analysis that could withstand these vulnerabilities.

Global convictions

EMERGING MARKETS

Domestic resilience amid global volatility

Yerlan SYZDYKOV

Global Head of Emerging Markets

The long-term (but non-linear) shift away from the dollar and robust EM-DM growth differential paint a constructive picture for emerging market assets. However, at the moment, the uncertainty surrounding President Trump’s next policy moves and their impact on trade negotiations and foreign policy is high – whether relating to conflict in the middle east, and trade with countries such as China, India.

In China, recent data has been benign and the country seems to have used its leverage (rare earth exports) in negotiations with the US. But the picture is clouded by weakness in the housing sector and lack of structural reforms. Overall, we are exploring domestic opportunities that are uncorrelated with the global cycle, with a strong selection bias.

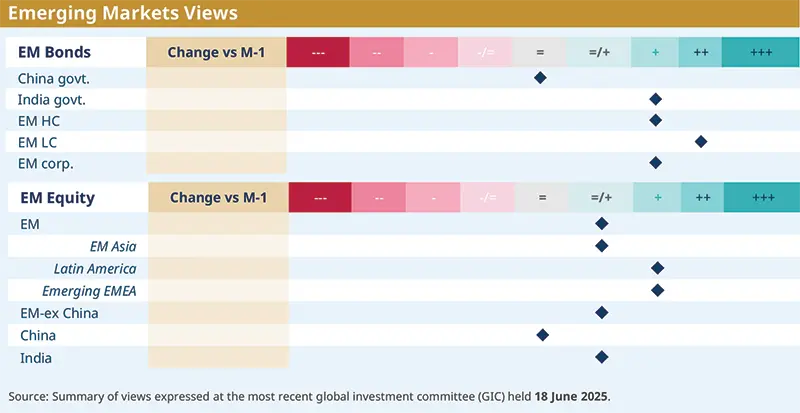

EM bonds

EM equities

Main convictions from Asia

Market resilience tested by rising geopolitical uncertainty. Asian markets continued to perform in the run-up to and after US-China trade talks. Limited macroeconomic impacts of tariffs so far, coupled with central banks’ easing, added support to investors’ sentiment. However, the recent escalation of conflict in the Middle East is putting that market resilience to the test. We are monitoring multiple channels of potential spillover effects to Asia via higher oil prices, geopolitical uncertainties and possible supply-chain disruption.

Selectivity in Asian bonds. The weak dollar and soft inflation continue to augur well for further policy easing by Asian central banks. If oil prices stay high for long due to the Israeli-Iran conflict, it may complicate agenda for some but won’t affect the region as a whole. We remain constructive on Asian rates and duration. For corporate credit, we continue to prefer quality IG names as stable income generators.

Macro backdrop remains supportive for Asian equities, but selectivity has gained prominence as valuation re-ratings have been impressive. The outlook for Korea has improved as the smooth election helped to clear political uncertainty and brighten the prospect of fiscal support. Policy easing and growth surprises are keeping India on the radar, although valuations may start becoming a hurdle for some. In China, we continue to seek selective opportunities in H (tech names) and A (stimulus-sensitive sectors) shares.

MULTI-ASSET

Stay risk-on, disciplined through hedges

Francesco SANDRINI John O’TOOLE

Head of Multi-Asset Strategies Head of Multi-Asset Investment Solutions

“We turned more positive on US 5Y keeping in mind that the longer end of the curve is at risk from high debt.”

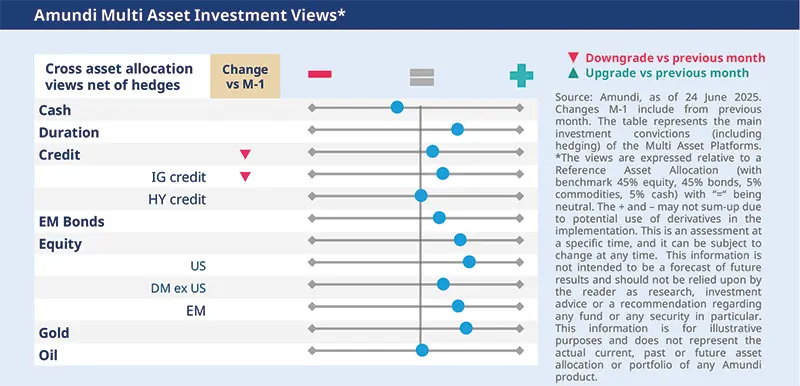

Macro conditions, liquidity and growth are reasonably supportive of risk assets. Corporate earnings prospects are also decent, but H2 would test whether companies are able to pass on the higher costs to consumers. This, coupled with high valuations in risk assets and geopolitical uncertainties, could lead to some consolidation but not an outright-sustained recapitulation. We maintain our positive view on risk assets, and believe investors should consider reinforcing hedges.

Equities have shown resilience in the face of ambiguous tariff policies and geopolitical tensions. We realize that valuations are becoming expensive, particularly in the US, but there are factors such as earnings growth, decent economic activity that keep us constructive overall including on the US mid-caps, Eurozone and the UK. We also see a need for better protections in the US. In EM, our stance is positive through China and particularly on the technology sector.

We are positive on duration but made slight adjustments. We upgraded views on US 5Y, in line with our expectations that the Fed will cut rates by more than what’s priced in by the markets. The long end of the US curve could come under pressure from higher deficits. At the same time, we closed our constructive view on EU 5Y but stay positive through 10Y that should gain from concerns over global growth. We are also optimistic on UK 10Y, on Italian BTPs, but are cautious on Japan. In credit, we reduced our positive stance on EU IG amid uncertainty over US-EU trade negotiations. This asset class still offers the best value in DM credit. We are also positive on EM spreads.

Uncertainties and high valuations in US equities underpin our view to enhance hedges in this segment and maintaining protections in Europe. In FX, we are cautious on the dollar but recognize this to be a consensus view and hence now see a need to hedge this. Finally, precious metals such as gold safeguard and complement our overall risk-on stance.

Amundi views by asset classes

IMPORTANT INFORMATION

The MSCI information may only be used for your internal use, may not be reproduced or disseminated in any form and may not be used as a basis for or a component of any financial instruments or products or indices. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each other person involved in or related to compiling, computing or creating any MSCI information (collectively, the “MSCI Parties”) expressly disclaims all warranties (including, without limitation, any warranty of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose) with respect to this information. Without limiting any of the foregoing, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including, without limitation, lost profits) or any other damages. (www.mscibarra.com).

The Global Industry Classification Standard (GICS) SM was developed by and is the exclusive property and a service mark of Standard & Poor's and MSCI. Neither Standard & Poor's, MSCI nor any other party involved in making or compiling any GICS classifications makes any express or implied warranties or representations with respect to such standard or classification (or the results to be obtained by the use thereof), and all such parties hereby expressly disclaim all warranties of originality, accuracy, completeness, merchantability or fitness for a particular purpose with respect to any of such standard or classification. Without limiting any of the forgoing, in no event shall Standard & Poor's, MSCI, any of their affiliates or any third party involved in making or compiling any GICS classification have any liability for any direct, indirect, special, punitive, consequential or any other damages (including lost profits) even if notified of the possibility of such damages.

This document is solely for informational purposes. This document does not constitute an offer to sell, a solicitation of an offer to buy, or a recommendation of any security or any other product or service. Any securities, products, or services referenced may not be registered for sale with the relevant authority in your jurisdiction and may not be regulated or supervised by any governmental or similar authority in your jurisdiction. The information contained in this document must not be altered or presented in a way that could give rise to misunderstanding or misrepresentation. Any use, reproduction, or distribution of the document’s content without full and proper reference to the original source is prohibited. Any information contained in this document may not be used as a basis for or a component of any financial instruments or products or indices. Furthermore, nothing in this document is intended to provide tax, legal, or investment advice. Unless otherwise stated, all information contained in this document is from Amundi Asset Management S.A.S. and is as of 30 June 2025. Diversification does not guarantee a profit or protect against a loss. This document is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The views expressed regarding market and economic trends are those of the author and not necessarily Amundi Asset Management S.A.S. or Amundi-Acba Asset Management CJSC and are subject to change at any time based on market and other conditions, and there can be no assurance that countries, markets or sectors will perform as expected. These views should not be relied upon as investment advice, a security recommendation, or as an indication of trading for any Amundi or Amundi-Acba product. Investment involves risks, including market, political, liquidity and currency risks. Furthermore, in no event shall Amundi or Amundi-Acba have any liability for any direct, indirect, special, incidental, punitive, consequential (including, without limitation, lost profits) or any other damages due to its use.

Date of first use: 30 June 2025.

"AMUNDI-ACBA ASSET MANAGEMENT" CJSC is a legal entity registered in Armenia, who, based on the Investment fund management license number 0002, provided by the Central Bank of Armenia, carries out mandatory pension fund management activities in Armenia. The registered office is located 10 Vazgen Sargsyan street, Premises 100-101, Yerevan, Armenia.

For more information about Amundi-Acba you can visit www.amundi-acba.am or call 011-310-000.